What is the federal funds rate?

The federal funds rate is the target interest rate range that banks charge one another for borrowing money. The rate then affects consumers because it will also impact the interest rates they pay on loans, such as car loans, HELOCs and other debt like credit card rates.

The Fed officials announced on May 7, they are holding rates steady this month, maintaining the target range to 4.25% to 4.50%.

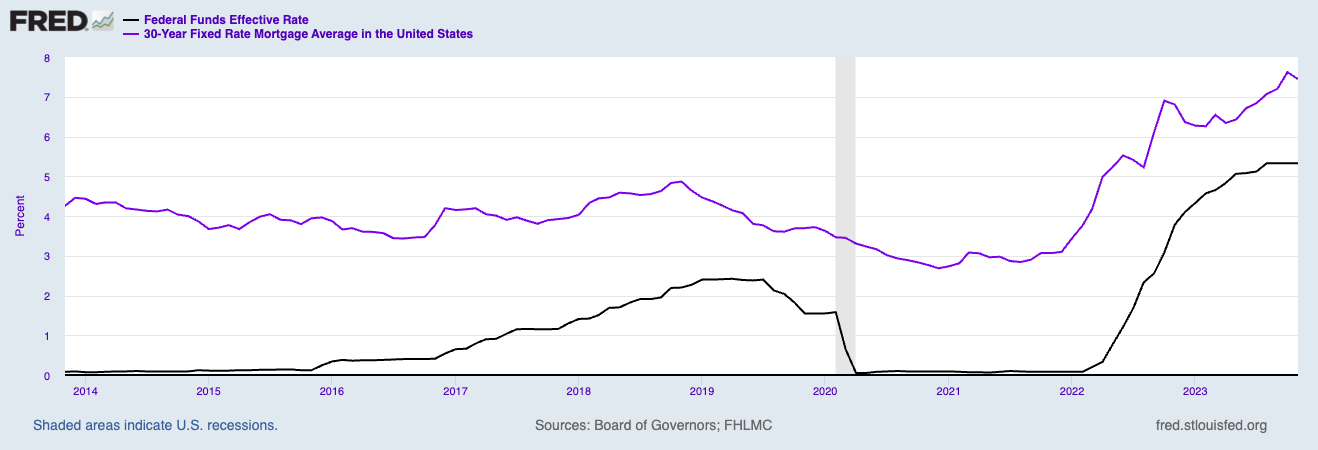

Today’s rates are a big departure from just a few years ago. Back in March 2020, the federal funds rate sat at near zero, and in June 2021 policymakers predicted there would be no rate hikes in 2022.

However, the Fed has increased the federal funds rate 11 times since then in an effort to combat inflation and slowly lowered rates to today's rage of 4.25% to 4.50% before deciding to hold rates steady since January.

Invest in real estate without the headache of being a landlord

Imagine owning a portfolio of thousands of well-managed single family rentals or a collection of cutting-edge industrial warehouses. You can now gain access to a $1B portfolio of income-producing real estate assets designed to deliver long-term growth from the comforts of your couch.

The best part? You don’t have to be a millionaire and can start investing in minutes.

Learn MoreUnderstanding the federal funds rate

The federal funds rate is dictated by Federal Reserve officials, specifically a 12-person committee — called the Federal Open Market Committee (FOMC) — that includes the chair of the Reserve, Jerome H. Powell. The FOMC meets eight times a year to discuss the rate, using indicators such as inflation to determine whether a hike is necessary.

The Fed interest rate hikes, or funds rate hikes, were meant to limit consumer demand. When the rate increases it indirectly affects the interest that consumers pay for loans, such as those used to buy a car or buy a house. Holding the rates steady after three consecutive rate drops suggests a wait-and-see strategy in the current economic and political climate.

At a press conference following the FOMC meeting, Fed Chair Jerome Powell said "despite heightened uncertainty, the economy is still in a solid position."

"We believe that the current stance of monetary policy leaves us well positioned to respond in a timely way to potential economic developments," he added, indicating agility is important in these uncertain times.

How the federal funds rate impacts borrowing

Mortgages

The federal funds rate helps dictate the prime rate and variable mortgage rates, though not the rates on fixed home loans. Even so, new fixed-rate loans have been getting more and more expensive.

During the earlier stages of the pandemic, the Fed kept fixed mortgage rates in check by buying billions worth of Treasury bonds and mortgage-backed securities every month. Those purchases helped "foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses," the central bank said.

But in May 2022, the Fed announced plans to begin selling off some of those assets.

The federal funds rate more directly affects other forms of borrowing, such as credit cards and car loans.

The federal funds rate and avg 30-year mtg rate, last 10 years

Credit cards

The interest rate hike also affects the interest you pay for credit card loans. The annual percentage rate (APR) determines how much you pay for any debt that is outstanding at the end of the month. The average APR has increased from 16% prior to 2022's first hike to 28.65% as January 3, 2025.

What does this mean for your credit card payments? Someone with a $15,000 credit card balance will now pay over $700 more in interest (compared to an APR of 16%).

Car loans

In the last quarter of 2022, the national average rate for a 60-month new car loan was 5.50% but that has increased with each rate hike. The average 60-month car loan rate sits at 8.40% as of August 2024, according to the Federal Reserve latest data.

However, keep in mind that factors such as credit score and vehicle type will affect your given rate.

HELOCs

Home equity lines of credit are also tied to the federal funds rate, although there is a less direct link. The interest rate for a HELOC is determined by the prime rate, which is usually 3% higher than the federal funds rate. Since HELOC lenders tie their rates to the prime rate, users with a variable rate HELOC will see their interest payments go up or down based on the federal funds rate.

When the federal funds rate increases, HELOC interest typically increases by the same amount. For a 10-year $30,000 HELOC, the average rate is 8.55% as of December 2024.

This 2 minute move could knock $500/year off your car insurance in 2025

OfficialCarInsurance.com lets you compare quotes from trusted brands, such as Progressive, Allstate and GEICO to make sure you're getting the best deal.

You can switch to a more affordable auto insurance option in 2 minutes by providing some information about yourself and your vehicle and choosing from their tailor-made results. Find offers as low as $29 a month.